Efficient transfer pricing documentation with Excel PowerPivot: transparency and traceability based on your GoBD data

Transfer pricing documentation is a major challenge for many internationally active companies. The effort involved in systematically documenting all transactions with foreign group companies in accordance with the requirements of the tax audit and at the same time ensuring traceability is considerable.

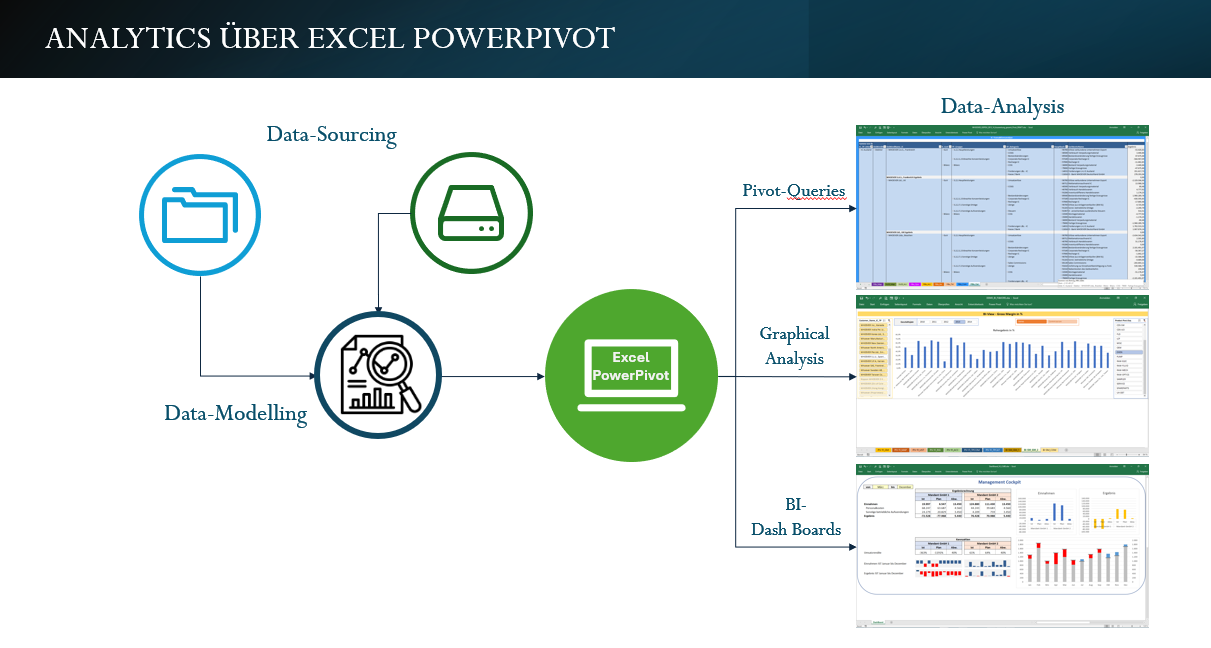

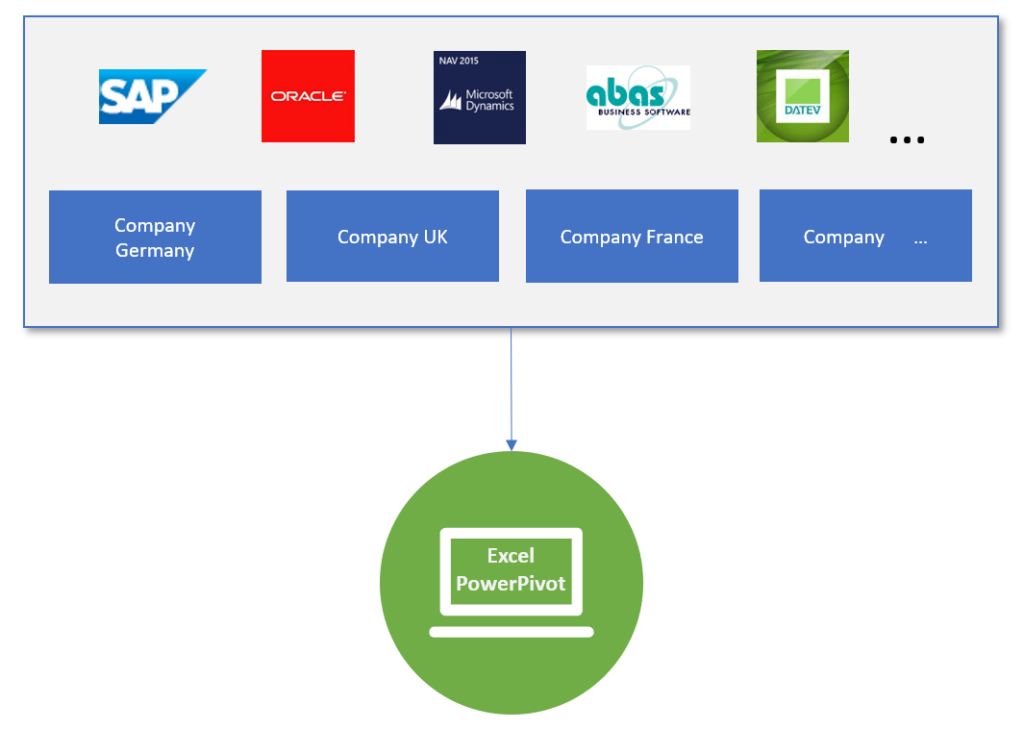

With my approach, which is based on Excel PowerPivot and your company’s GoBD data, I offer an efficient, transparent and cost-effective solution.

My approach to transfer pricing documentation

1. Development of a structured data architecture:

-

- The solution is based on a carefully developed data architecture that is individually tailored to the requirements of your company and the transfer pricing documentation.

- Based on your GoBD-compliant data, I extract the relevant transactions (e.g. goods transfers, services, financial transactions) from the booking data, supplemented by secondary tables for additional information such as accounts, cost centers or business partner details.

- The data is organized in a relational database (MS SQL Server), with SQL joins ensuring that all the necessary details are brought together in a central query table.

2. Automated grouping of transactions:

-

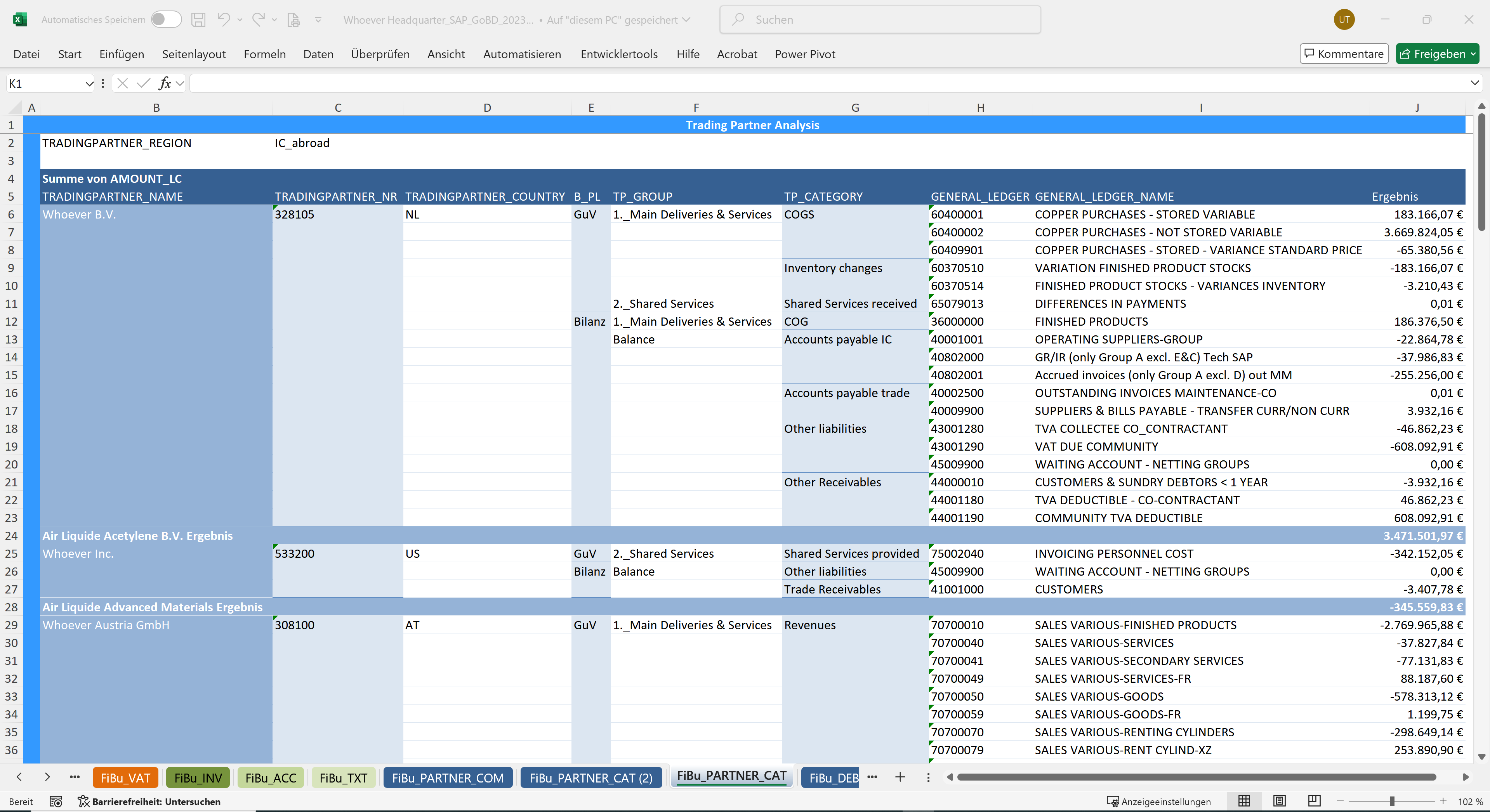

- The generated query table is structured in such a way that all transactions can be systematically displayed according to groups (e.g. deliveries, license fees, loans).

- This enables a clear and concise allocation of all documented business transactions to the requirements of the transfer pricing documentation.

3. Analysis and drill-through down to individual booking level:

-

- The query table is imported via Excel PowerPivot so that you can analyze the data flexibly.

- Drill-through functions ensure that the documentation is not only available at an aggregated level, but can also be broken down to individual posting level if required – a decisive advantage during tax audits.

4. Secure traceability in one central file:

-

- All documented transactions are consistently and comprehensibly documented in a single file.

- This ensures a high level of transparency and makes communication with the tax authorities much easier.

The advantages of my approach compared to alternative solutions

1. GoBD compliance and efficiency:

-

- My approach is based entirely on your GoBD-compliant data. This ensures that your transfer pricing documentation meets the requirements of the tax audit.

- You remain audit-ready at all times and can respond quickly and precisely to requests from the tax authorities.

2. Flexibility and user-friendliness:

-

- With Excel PowerPivot, you use a tool that is already available in your company and with which your employees are familiar.

- The solution integrates seamlessly into your existing processes and requires no additional training or software costs.

3. Systematic presentation and drill-through:

-

- The systematic grouping of transactions by category facilitates analysis and reporting.

- With the drill-through function, you can view details of individual bookings if required, thus ensuring traceability at all levels.

4. Always one step ahead of the tax audit:

-

- Thanks to the automated, structured processing and traceability of all transactions, you are optimally prepared for audits.

- The solution enables you not only to meet the requirements of the tax audit, but also to stay one step ahead of it.

Excel’s tab functionality is ideal for displaying posting columns according to individual account numbers, document numbers, cost center numbers or even performing a comprehensive text search. This flexibility of ExcelPowerpivot also helps with many topics and analyses far beyond international transfer pricing. Think of VAT validation, support for consolidation, fraud detection, etc.

Conclusion: Transfer pricing documentation made easy

With my approach, transfer pricing documentation becomes a clearly structured and transparent process. The combination of GoBD-compliant data, a flexible data architecture and the powerful analysis functions of Excel PowerPivot enables you to document transactions with foreign group companies efficiently and comprehensibly.

Always stay one step ahead of the tax audit – with a solution that is based on your company’s on-board resources.

Contact me and let’s take your transfer pricing documentation to the next level!