AI-supported transfer pricing documentation process: efficiency and security rethought

The preparation of transfer pricing documentation presents companies with complex challenges. Traditionally a resource-intensive task, the use of artificial intelligence (AI) offers a forward-looking solution that ensures efficiency, precision and compliance in equal measure. The systematic use of AI in transfer pricing documentation not only optimizes the process, but also increases transparency and minimizes risk. In the following, I will explain the structured, AI-supported process that enables secure and reliable documentation – with the 3Q-Approach as the key to ethical and controlled AI use.

Systematic AI-supported process flow

The AI-supported process for transfer pricing documentation is based on several clearly defined steps that cover the entire documentation process and maximize efficiency:

1. Template-based creation of documentation

The use of standardized templates and AI-supported question clusters not only makes documentation more efficient, but also more secure. This step reduces manual effort and ensures that all relevant information is recorded accurately – a stable basis for the entire documentation.

2. AI-TP-Assistant

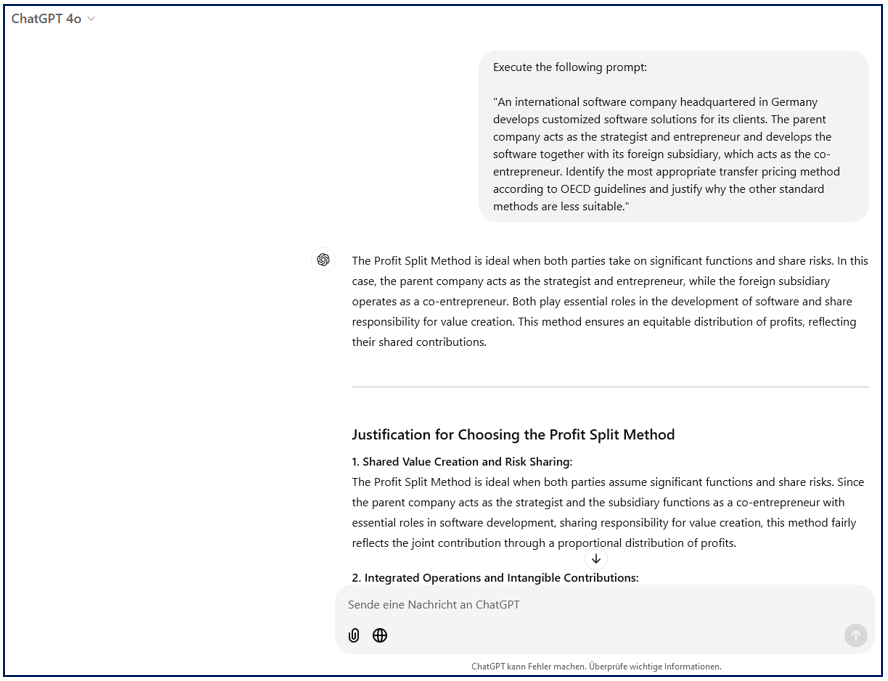

The AI-TP-Assistant is specially tailored to the requirements of your company and supports the entire transfer pricing documentation process. From data collection and analysis to functional and risk analysis and appropriateness documentation, the AI-TP-Assistant provides comprehensive support and even ensures compliance with all regulatory requirements.

The AI-TP-Assistant is preferably installed via ChatGPT, but can also be flexibly combined with other AI models such as Perplexity AI, Copilot and others to ensure even broader data collection and more precise analysis.

This versatility ensures that the AI-TP-Assistant is optimally tailored to the individual needs and specific data landscape of your company.

3. Horizontal data and information procurement and analysis

AI enables the systematic collection and analysis of data and information across the entire documentation process. This creates a well-founded and consistent information base that ensures precise documentation and uniform presentation.

4. Vertical procedures for complex Process Nodes

Complex tasks such as at arm’s length documentation and functional & risk analyses are supported by specialized AI routines. These vertical procedures at such process nodes ensure compliance with regulatory requirements and allow an in-depth, detailed review of the documentation – a crucial component for quality assurance.

5. CCR-Routine for Completion, Compliance and Risk Check

Multi-stage validation by AI enables a comprehensive completion, compliance and risk check. This routine minimizes potential sources of error and promotes the accuracy and legal certainty of all transfer pricing documentation.

6. 3Q-Map for final review

At the end of the process, a detached, final check is carried out by a human, who ensures the validity and relevance of the data independently of the AI results.

The 3Q-Approach is used here, which combines artificial intelligence (AI), relative intelligence (RI) and quantum field intelligence (QI) and thus enables a holistic validation of the results. This approach emphasizes that humans, with their experience and skills, always stand above AI and are able to evaluate and adapt the results of AI in a differentiated manner.

The 3Q-Approach ensures that control over the AI remains in human hands and incorporates ethical and strategic considerations into the decision – so that the technology supports people without replacing them.

Practical example: Transfer pricing documentation for multinational groups

A typical field of application for this AI-supported process is international transfer pricing documentation. A horizontal AI process line covers structured information such as historical developments, business areas and competitive analyses. At the same time, vertical AI routines, including functional and risk analysis and appropriateness documentation, ensure that all critical requirements are comprehensively met.

Conclusion: Why companies should rely on AI-supported documentation processes

The use of AI in transfer pricing documentation increases efficiency, reduces manual effort and minimizes the risk of errors.

Unternehmen profitieren von erhöhter Produktivität, besserer Compliance und einer flexiblen Anpassungsfähigkeit an neue regulatorische Anforderungen. Companies benefit from increased productivity, better compliance and flexible adaptability to new regulatory requirements.

Precise and structured documentation with AI also ensures greater security during tax audits. Automated compliance checks and comprehensive data validation ensure that the documentation meets the requirements and that risks can be identified and addressed at an early stage.

With the 3Q approach, the use of AI is ethically sound and aligned with human values – an important basis for sustainable success. Companies that rely on this systematic and future-proof approach create a competitive advantage in a dynamic, globalized economy and are also optimally protected for tax audits.

As I work exclusively with on-board resources, no additional software investments are required, which enables cost-efficient implementation.